Acker Market Insights First Half 2024

Acker Market Insights

first half 2024

NEW YORK - June 27, 2024

INTRODUCTION

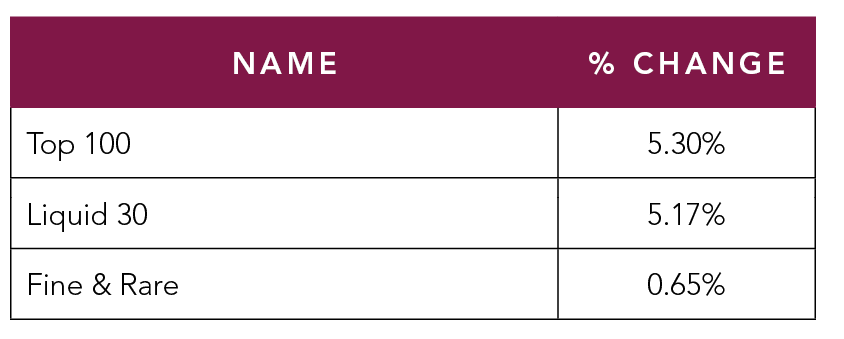

The first half of 2024 demonstrated stability in the fine wine market, characterized by increased volume and a 5% rise in both Acker’s Top 30 and Top 100 indices. The overall Fine & Rare Wine Index saw a modest increase of 0.65%. Acker achieved a 42% global market share, with a 15% increase in volume and nearly 5,000 new world records. Additionally, our global retail and private sales division experienced record volumes during this period.

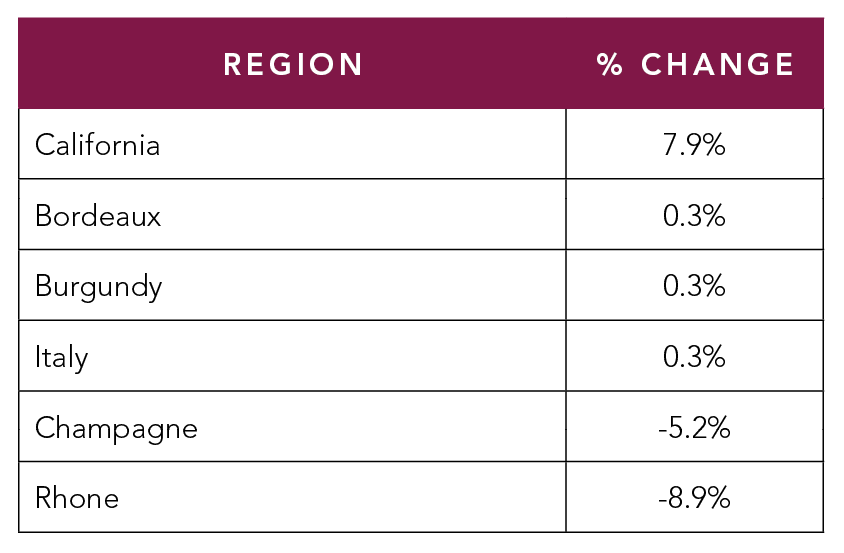

A significant highlight of the first six months was the surge in old Bordeaux wines, with volumes of pre-1975 vintages rising over 200%. Demand for these wines remains exceptionally strong, with our historic Bordeaux indices dominating the top five indices of 2024. Burgundy showed healthy market stability, with 83% of the top world records set by Burgundy wines. Our California index was the top regional performer, rebounding by 7.9%, while Champagne and Rhone experienced softer prices.

Young Bordeaux continued to face distribution challenges from 2023, although supply pressure is significantly easing. The top overall producers from the two largest volume regions were Chateau Lafite and Chateau Palmer from Bordeaux, and Pierre-Yves Colin-Morey and Comte Liger-Belair from Burgundy.

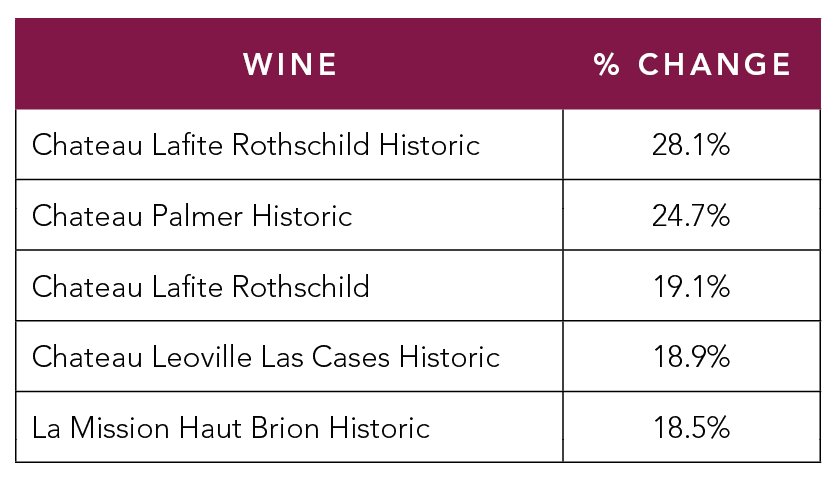

top 5 indices overall

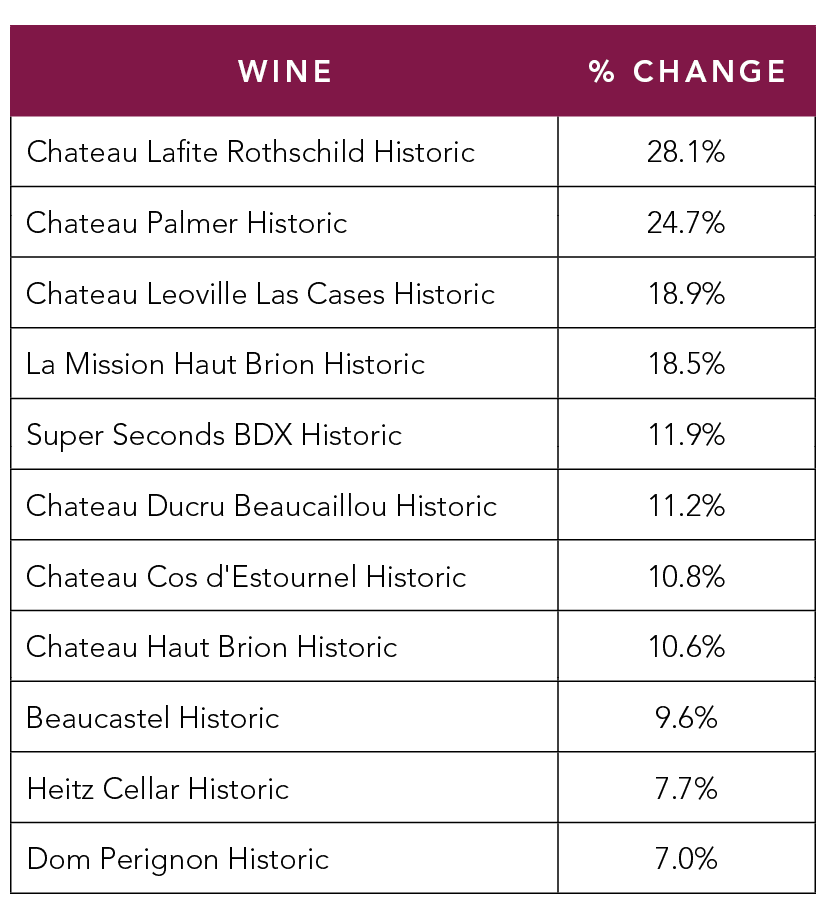

top 10 historic indices*

*Historic Indices are comprised of a selection of the most traded wines from a given producer before the year 2000. The selection of wines and the index’s pricing scale are static as of the index’s creation date.

Overall, global demand and distribution of buyers were much healthier in 2024, although the Asia market continued to be impacted by the Chinese economy. In a hopeful sign, activity from the other Greater Asia countries has stabilized and begun to increase.

The strong regional performance of the California Index was driven by wines of the 1990’s and 1980’s, specifically Dunn, Heitz Cellar, Screaming Eagle and Shafer, all with gains over 10%.

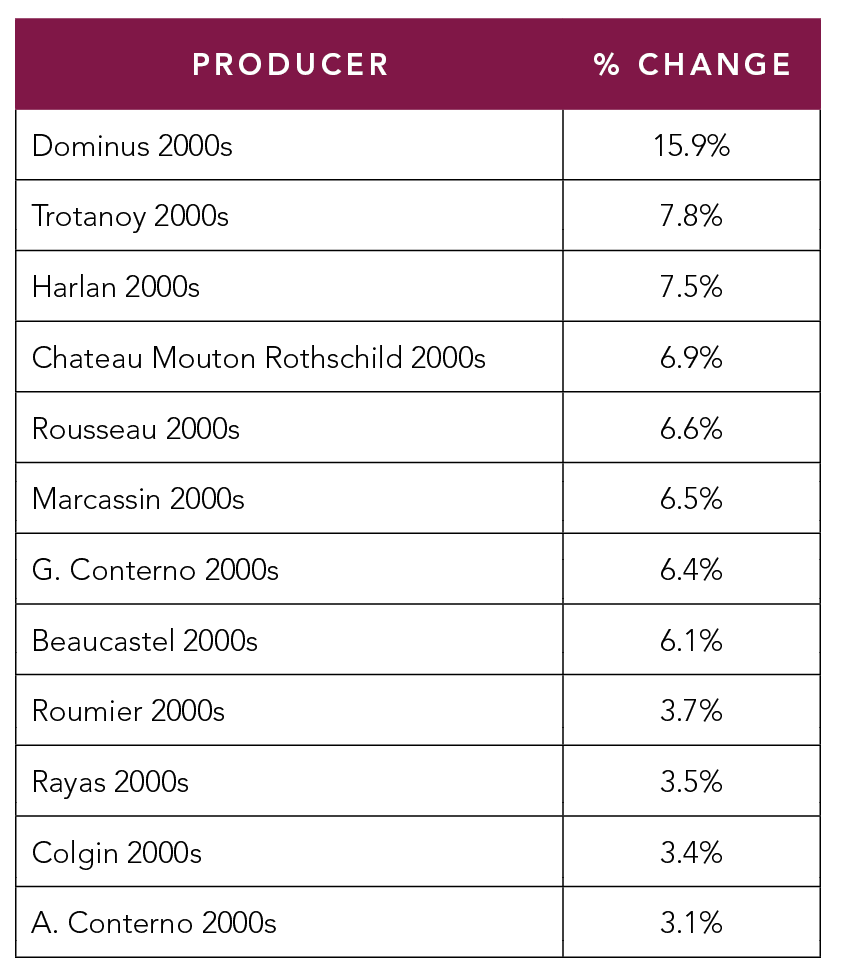

The demand for wines of the 2000-2010 period remained strong across most of the regions as indicated by the top 2000’s indices.

regional performance

Acker Indices

top 2000s indices*

*2000s Indices are comprised of a selection of the most traded wines from a given producer between the year 2000 and 2020. The selection of wines and index’s pricing scale are static as of the index’s creation date.

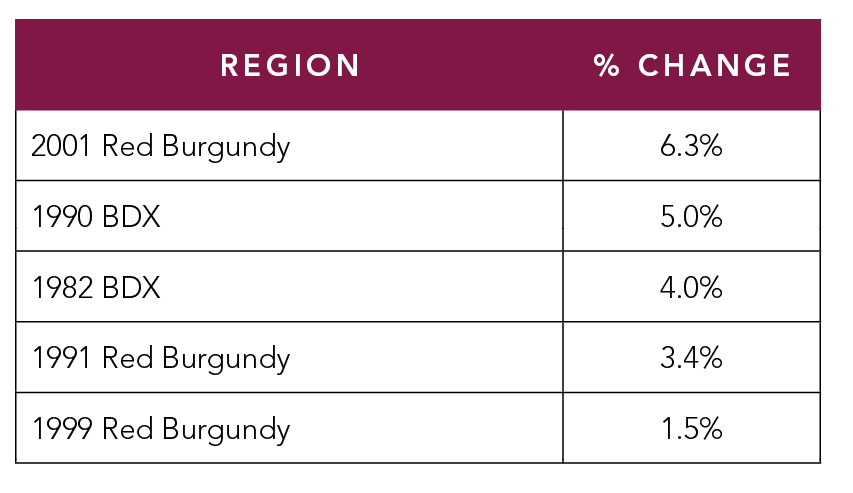

top vintage performers

The top vintage performers were split between Burgundy and Bordeaux.

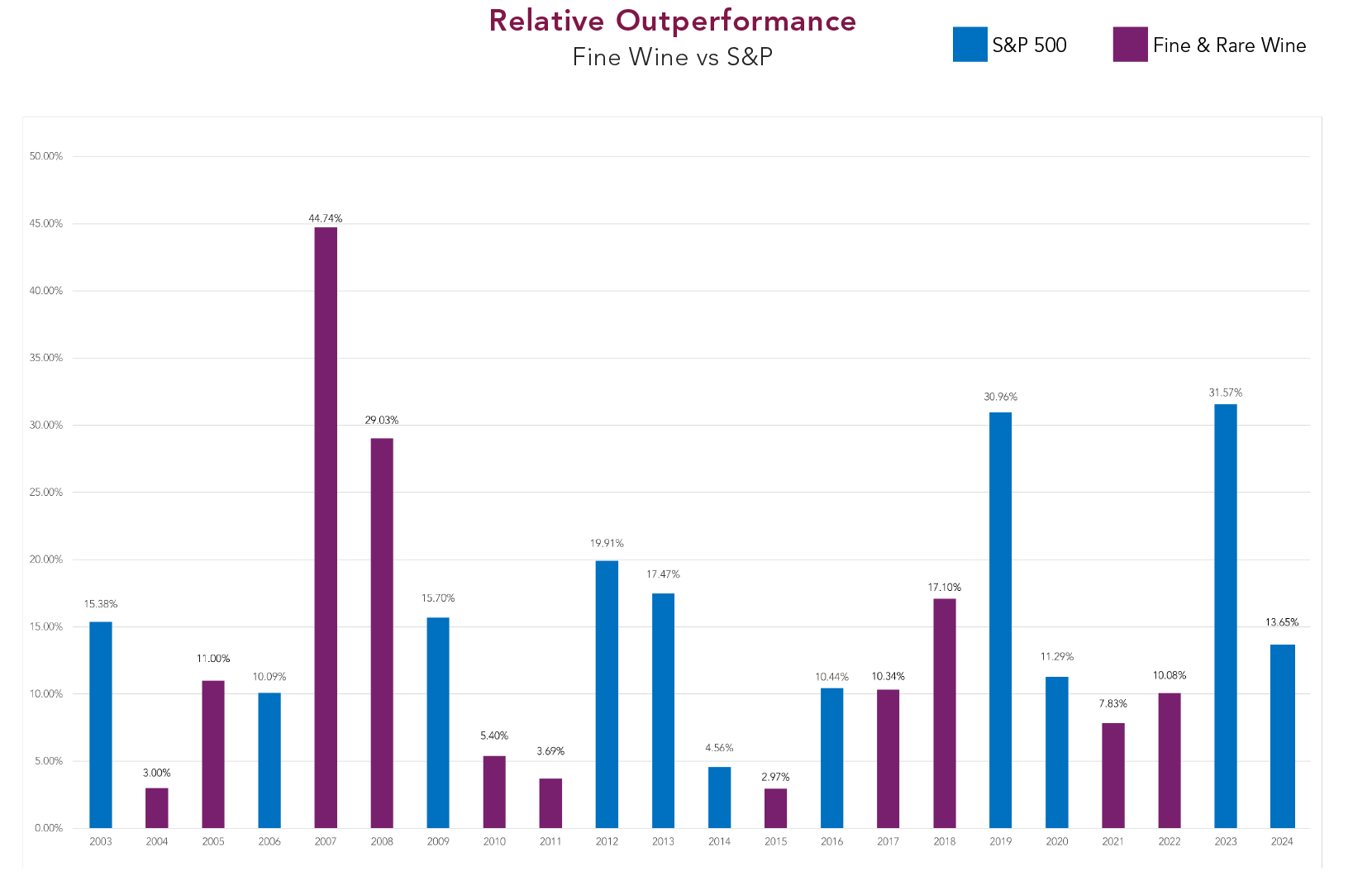

As highlighted in our annual report, the outperformance of stocks relative to wine in 2023 was the largest ever recorded, and this trend continued, albeit at a much slower pace. It is important to note that most of the performance of stock indices has been dominated by seven specific stocks, and this narrow breadth of performance is distorting historical comparisons.

Summary

The fine wine market stabilized in the first half of 2024, indicating a promising and dynamic market for the latter half of the year. Historically, the wine market has shown no statistical evidence of being influenced by elections. We believe the stabilization observed in the first half, along with several positive indicators such as increases in number, breadth and geographical distribution of buyers has set the stage for overall price increases and a healthy market in the second half of 2024. Wishing everyone an enjoyable summer.

IRVIN GOLDMAN

Chief Executive Officer